mimo x WOWswap Partner for Decentralized Leveraged Trading

With over $22M+ in liquidity, mimo's users, volumes, and supported tokens are at an all-time high! In the past few weeks, we have seen new yield farms like ZoomSwap and MagicLand build upon mimo's liquidity pools and drive sharp increases in TVL. Today, we are further expanding the functionality of mimo through a new partnership with WOWswap, a decentralized leveraged trading protocol launched on BSC, Polygon, HECO, and now IoTeX.

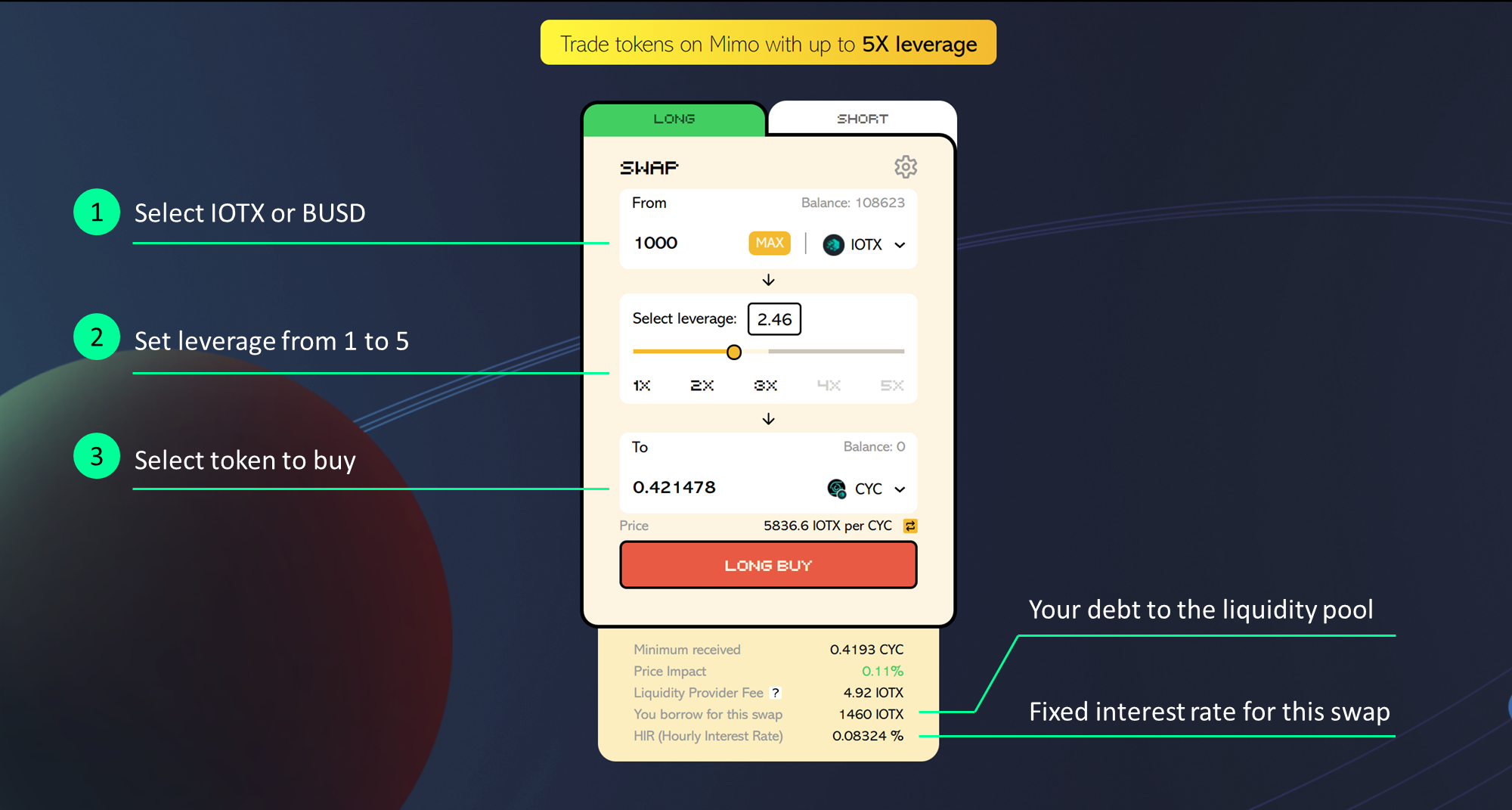

WOWswap utilizes liquidity from mimo to enable users to trade popular IoTeX tokens with up to 5x leverage. BTC, CYC, ETH, GFT, and IOTX are now available for leveraged trading with more tokens coming soon.

If you are new to leveraged trading, please see this overview. You can also purchase the WOW governance token on mimo here.

How does WOWswap work?

When you buy a token with leverage on WOWSwap, you finance only a portion of the purchase with your own capital — the rest of the funds you borrow from a liquidity pool by depositing IOTX or BUSD as collateral.

For Leverage Traders

After you complete a swap you will get “proxy-tokens”, which are pegged 1:1 to real tokens held by WOW smart contracts. Proxy-tokens are needed for the protocol to guarantee the repayment of your loan once you sell proxy-tokens back for BUSD. The protocol will change proxy-tokens to real tokens, exchange real tokens for BUSD on mimo, repay the loan to the liquidity pool, and transfer the rest of the funds to you. For more information on how to open/close a leveraged position with WOWswap, see these instructions.

For Liquidity Providers

Anyone can become a WOWswap liquidity provider and earn interest by supplying liquidity.When a trader opens a leveraged trading position (long or short), they take a loan from the WOWswap liquidity pool at a current Hourly Interest Rate (HIR). When a liquidity provide deposits assets into a liquidity pool, he/she will get interest-bearing tokens representing the their share of the liquidity pool. When a liquidity provider wants to withdraw liquidity, they should convert their interest-bearing tokens back to the deposited asset. For more information on how to become a WOWswap liquidity provider, see these instructions.

Other questions?

Review WOWswap's comprehensive docs here.

About mimo

mimo is a decentralized liquidity protocol that will fuel the next wave of decentralized finance (DeFi) on IoTeX. mimo’s vision is to empower next-gen DeFi products that utilize our state-of-the-art automated liquidity protocol and the IoTeX's lightning-fast speed, low gas fees, and cross-chain capabilities.