mimo: DEX + vePICO + DAO

Introduction

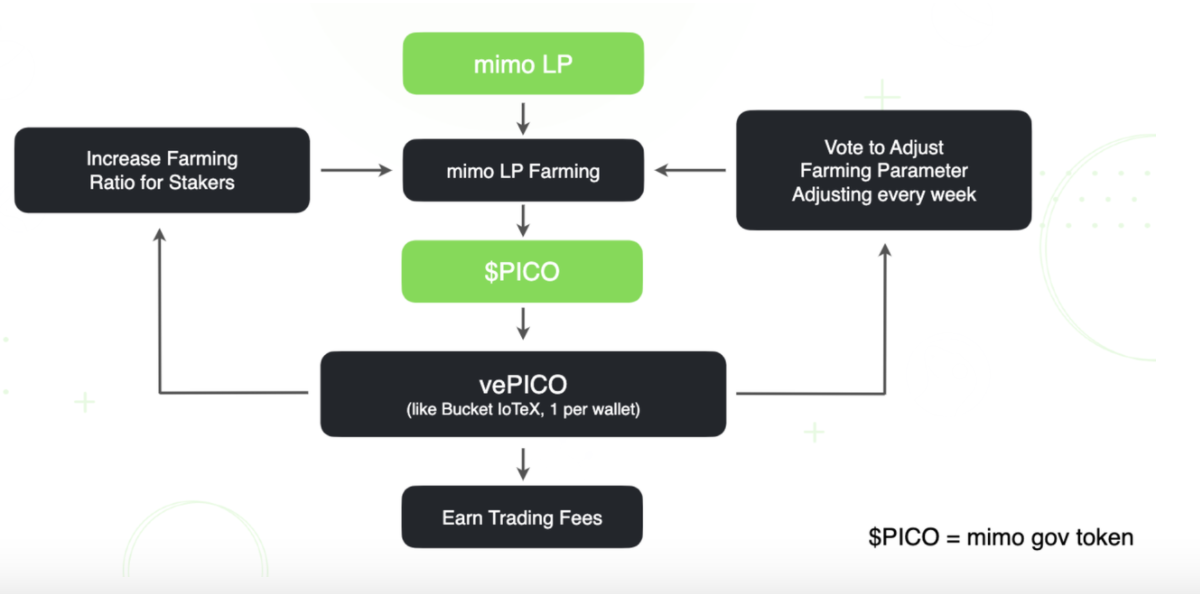

What's new about mimo tokenomics? We’ve introduced an innovative DEX protocol model based on the veCRV tokenomics model, and governed by a DAO entity.

Why is this important?

It’s important that the tokenomic model aligns user incentives and optimizes for long-term performance. This model is premised on the idea that people who timelock tokens the longest are most committed to the protocol and therefore should have the greatest sway on the governance of the protocol.

DEXs are a critical piece of DeFi ecosystems. They provide liquidity by offering rewards to liquidity providers. However, these incentives can misalign yield distribution across pools and cause mercenary mining behavior. People chase unsustainable returns and then pull their investments from LP Pools. This hurts the protocol in the long term.

To address this, we have introduced the vePICO token model, based on the veCurve tokenomics model, to mitigate short-term mercenary mining behavior. We are doing this by empowering PICO with additional token utility. To create a decentralized autonomy protocol, a DAO is set up to govern the protocol's decision making process.

Let's examine this in greater detail.

The mimo DEX

mimo is a fully decentralized protocol with automated liquidity to fuel the future of DeFi. Powered by the IoTeX blockchain, mimo utilizes smart contracts and automated market making (AMM) algorithms to manage liquidity pools and connect buyers and sellers of crypto assets.

An automated market maker allows individual buyers and sellers of tokens to execute these trades peer-to-peer. Without this peer-to-peer automation, people would have to go through a centralized entity that has created a market for various token pairs.The first instantiation of the mimo protocol, on mimo.exchange, was a decentralized exchange (DEX) for peer-to-peer trading of Ethereum, BNB Chain (BSC), Polygon, and IoTeX assets.

Mimo's TVL has averaged over $38 million and now has 457 listed LP pairs.

What are mimo's advantages

- Permissionless trading pairs let people easily create token pairs on mimo by selecting from the existing list of tokens, providing the tokens' symbol, or wallet addresses.

- Low transaction fees The fees on mimo are very low because mimo is built on the IoTeX blockchain. Typically, gas fees are a fraction of a cent and transaction speeds average 5 seconds.

- PICO incentive farming

As new XRC20 tokens are onboarded to IoTeX, mimo's Yield Farms will enable liquidity providers to stake (deposit) their LP tokens to listed LP pools and earn PICO as well as additional yield. This additional yield is possible by staking PICO which results in the creation of vePICO. Depending on the staking duration, i.e. how long the PICO has been locked, this additional yield could be as much as 2.5 times as it would be without staking. That's the significant value that vePICO rewards to PICO stakers.

vePICO Explained

What is the mimo DAO and who are its members?

The mimo DAO is a decentralized autonomous organization (DAO) formed to manage the mimo platform. Its members are vePICO holders, who play an active part of the governance of the DAO by voting on proposals.

What can the mimo DAO do?

- Manage the treasury To help mimo become a better protocol, the members of mimo's DAO can vote on issues of treasury management, including spending, borrowing, assets allocation and reporting.

- Decide the gauge weights, i.e. the percentage of PICO to be distributed among all gauges. Protocols wishing to get PICO rewards on mimo must use vePICO to make a proposal to be added as a guage. The members of the mimo DAO then vote on whether or not to approve the proposal.

- Adjust mimo protocol's parameters PICO reward can be adjusted to control token inflation. The members of mimo DAO can vote to decide this PICO emission rate.

How are decisions made by the mimo DAO?

Issues being considered by the members of the mimo DAO are discussed in the mimo forum. The merits of any given proposal are examined and weighed before being voted on. Voting can take place either OnChain or, once the discussion is done, a proposal will be drafted and published on snapshot for vePICO voting to pass or reject. If the proposal is approved, that item then enters the execution phase. In this phase, depending on the nature of proposal, the core team may deploy a contract to adjust parameter or other such action as determined by the proposal.

PICO + vePICO + mimoDAO Individual investors and projects provide liquidity to get LP tokens and collect PICO in farming. Those investors and projects can then stake their PICO to receive vePICO. With vePICO, LP providers can boost their farming rewards up to 2.5x and earn protocol trading fees as passive earnings. vePICO holders are granted the right to vote on proposals being considered in the mimo DAO. Their voting power is determined by the amount of vePICO they have.

What's next

In our next blog we'll explain the PICO farming plan, the Initial Distribution, and the Launch Campaign Timeline.